Flippa vs Empire Flippers: The Real Differences That Matter

October 15, 2025

I spent a weird Tuesday night sitting in my driveway comparing these two platforms after a deal I was watching disappeared before I could move on it. Roughly 9 out of 10 businesses I submitted notes on through the curated one got filtered before I even saw them. The open one let me browse everything, which sounds better until you realize how much noise that creates. Different tools, genuinely different experiences.

Quick Matcher

Flippa or Empire Flippers - which fits your deal?

Answer 4 questions. Get a data-backed recommendation based on real platform differences.

The Quick Answer

I listed a site on both platforms the same week. Different properties, but close enough in size that I could actually compare the experience. Here is what I found in the flippa vs empire flippers decision that nobody really says out loud.

Choose Flippa if: You are selling something under $50K, your margins are thin, or your business would not survive their vetting process. I submitted one property there and it was live in about two days. No call, no deep dive, no waiting.

Choose Empire Flippers if: You are clearing at least $2,000 a month net and you want someone else to handle the buyer conversations. I ran roughly 11 back-and-forths with buyers on Flippa myself before one deal closed. On the other platform, most of that got handled without me.

Flippa: The Open Marketplace

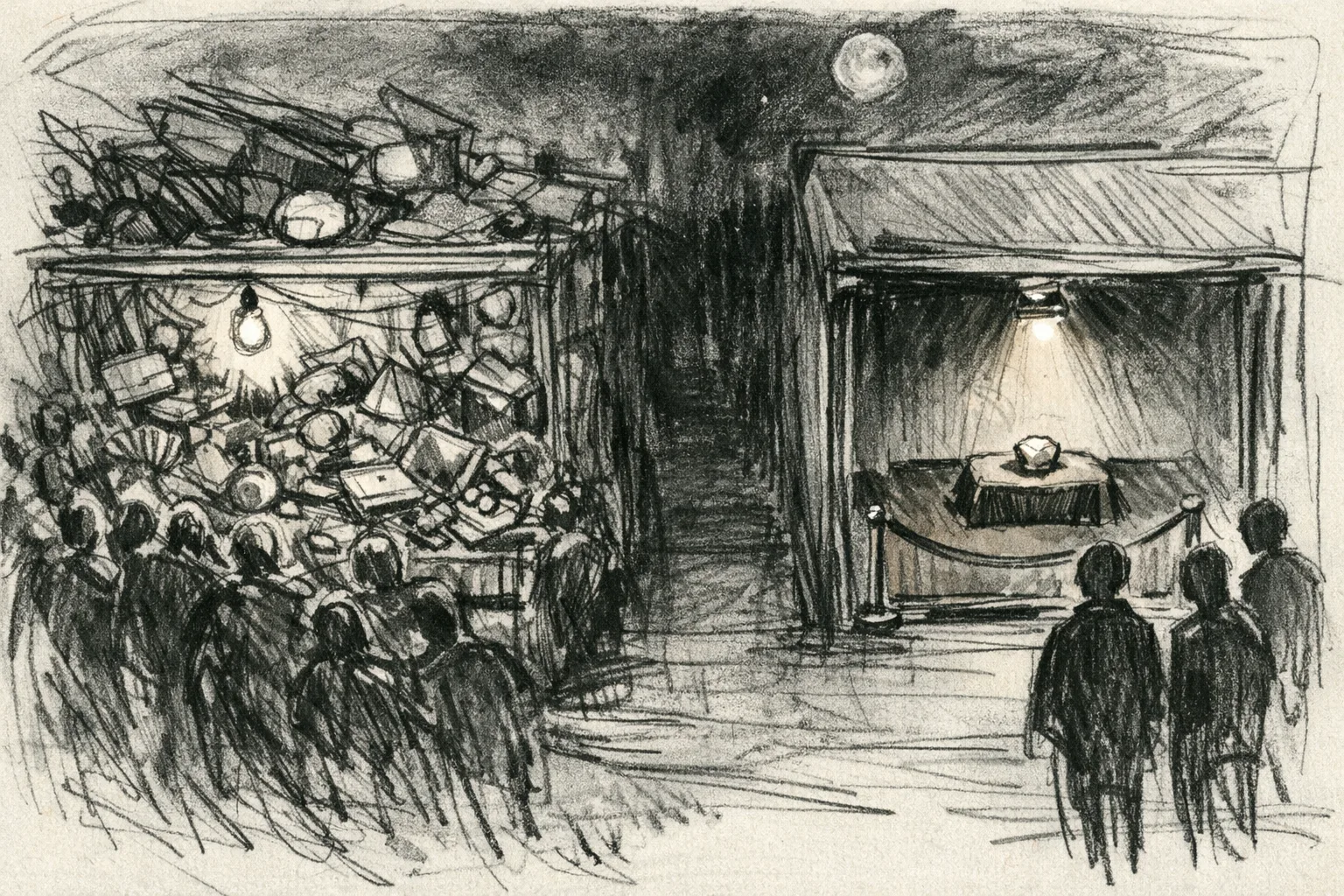

I found this platform at maybe 1am on a Wednesday, sitting in my car in the parking lot of a Walgreens because the wifi at my apartment was out and I needed to pull comps on a content site I was thinking about flipping. The sheer volume of listings hit me immediately. Hundreds of them. Everything from what looked like a half-built Shopify store to actual SaaS businesses with recurring revenue. It felt like walking into a flea market that also happened to sell Ferraris.

The buyer pool is genuinely massive. Over 600,000 registered buyers. I don't say that like it's a selling point I memorized. I say it because I listed a small affiliate site and within 48 hours I had 14 people in my inbox, which I was not prepared for. Some of them were serious. Some of them were clearly just kicking tires. A few I still can't explain.

The Fee Structure

Listing fees depend on where your business falls in terms of valuation. Entry-level listings under $10K run you $29 upfront. Standard listings from $10K to $999K will cost $59 to $99 depending on what you choose. Premium listings with added exposure and NDA options go from $399 to $699. Brokered service for businesses $100K and above is $999 for a nine-month term, with success fees that drop down to the 3-8% range.

Success fees for self-serve listings are 10% on anything under $50K, and that percentage steps down as the sale price climbs. The part that stung when I actually did the math: that 10% is on the full sale price, not your margin. I sold a site for $38K that I had maybe $28K into. The fee didn't care about my cost basis. It just saw $38K and did the math accordingly.

The listing fee is non-refundable if your business doesn't sell. I found that out after the fact, not before.

For larger deals, there's a full broker service that assigns you an actual M&A advisor. I didn't use it personally, but Derek did last spring for something in the low six figures and said the advisor was responsive and knew what they were doing. He closed in about 71 days, which tracked with the platform's own data on deals in that range.

What actually worked

- No minimums: You can list without hitting some revenue or age threshold first. That mattered when I was starting out.

- Buyer volume: The reach is real. I got ~23 buyer contacts on my first listing before the first week was out.

- Lower success fees on smaller deals: 10% is more palatable than what the more curated platforms charge at the same price point.

- Auction format: I watched a site I had my eye on go into a bidding war. Painful as a buyer. Useful to understand as a seller.

- Integrated documents: LOIs and APAs built into the platform. I didn't have to chase a template at midnight.

What fought me

- No vetting on lower listings: I once watched a legitimate $20K SaaS get zero serious bids because it was sandwiched between obvious scams and things that were just repackaged templates. The signal-to-noise ratio is brutal and you feel it.

- First Access program: Paying buyers get 21-day early access before listings go public. I missed two sites I wanted because of this. As a seller, it means your first three weeks of exposure are throttled unless buyers are subscribed. That's not a small thing.

- No migration support on self-serve: The transfer is entirely on you. I handled one at 11pm on a Friday from my phone because the buyer was in a different timezone and we were both trying to close before the weekend. It worked but it was not elegant.

- Lower multiples: Buyers here expect a deal. If you want top-of-market pricing, this environment works against you.

Sale timelines from their own data

- Under $50K: 15 days

- $50K to $250K: 49 days

- $250K and above: 73 days

Those felt accurate to what I observed. Smaller deals move fast because buyers don't need six weeks of due diligence on a $15K site. Larger deals slow down the way any acquisition does when real money is on the table.

The First Access controversy is worth sitting with for a minute. The platform built its identity on being an open marketplace. Putting the best inventory behind a $49/month paywall changes what that means. I'm not saying it's wrong exactly. I'm saying it's a different product than what people think they're signing up for, and that gap matters when you're deciding where to list or where to look.

Check out Flippa's marketplace →

Empire Flippers: The Premium Broker

Empire Flippers is a different animal entirely. I submitted a site there during a genuinely rough stretch – I was sleeping maybe four hours a night, had a family thing going sideways, and I figured getting the business off my plate would help. The vetting process started almost immediately, and that was both reassuring and uncomfortable.

They rejected 91% of submissions, which I had read before applying. I did not fully believe it until I watched them come back to me three separate times asking for additional documentation before they would even confirm I was in consideration. They wanted Google Analytics access, 12 months of financials, and proof that my traffic was clean. Not summaries. The actual accounts. I gave them everything and sat with that feeling for about two weeks.

The requirements are not suggestions. Your business has to average at least $2,000 in monthly net profit over the prior 12 months. You need verifiable traffic data. No URL changes in the last year for affiliate or AdSense sites. No manipulated rankings, no fake social signals, no revenue that leans more than 50% on a single client for service businesses. I asked Chris to look over my numbers before I submitted because I was not confident my bookkeeping would survive scrutiny. It did, barely.

The commission is 15% flat on anything under $700,000. On a $600,000 sale that is $90,000 out the door. I ran that number from my car in a parking lot one night and just stared at it. It is steep. What shifted my thinking was realizing that their 94.1% sell-through rate is not marketing copy – it tracks with what I saw. Most things listed there actually move. That changes the math on what the fee is really buying you.

The listing went live on a Monday at 10 AM. I know this because I had set a reminder. By Wednesday I had two verified buyers asking detailed questions. Both had already been screened. That part worked exactly the way they said it would, and I was not prepared for how fast it moved after weeks of slow documentation.

What I liked, put plainly:

The vetting cuts both ways. Every buyer who contacted me had already proven they had funds. I did not spend time on tire kickers. Migration support is included and they actually handle it, which saved me a conversation with Jamie that I did not want to have at that moment. The listing page they built was more detailed than anything I would have written myself. No upfront fees. Free escrow baked in. Post-sale inspection period of 14 days gave the buyer a window and made the close feel less adversarial.

What fought me:

The 60-day exclusivity window is not negotiable. You cannot list elsewhere while they work your deal. I felt that. The vetting timeline ran close to three weeks before I was live, which is a long time when you are already running on empty. If your business earns under $2,000 a month net, this is not your platform, full stop. And in a competitive listing window, the best opportunities move in under 48 hours, which is its own kind of pressure if you are a buyer.

Average time from listing to close runs around 109 days. Mine came in faster. Sites under $100,000 tend to move quicker. Unusual business models or high asking prices slow things down considerably.

The thing I keep coming back to in the flippa vs empire flippers conversation is this: Empire Flippers is not trying to serve everyone and they are not hiding that. The bar is high, the process is invasive, and the commission is real money. But I handed over my business's underwear drawer, as Derek once put it, and what came back out the other side was a clean deal with a buyer who was actually ready. For where I was that month, that was worth more than I expected.

Fee Comparison: Real Numbers

Let's look at what you'd actually pay on each platform:

Jamie-Jack's son-brought donuts for everyone this morning and thanked me for taking one. I took three more. He thanked me again.

| Sale Price | Flippa Fees (self-service) | Flippa Brokered | Empire Flippers Fees |

|---|---|---|---|

| $25,000 | $29-99 listing + $2,500 (10%) = ~$2,600 | Not available | $3,750 (15%) |

| $50,000 | $59-99 listing + $5,000 (10%) = ~$5,100 | Not available | $7,500 (15%) |

| $100,000 | $99 listing + ~$10,000 (10%) = ~$10,100 | $999 + $6,000 (6%) = $6,999 | $15,000 (15%) |

| $250,000 | Not recommended | $999 + ~$10,000 (4%) = ~$11,000 | $37,500 (15%) |

| $500,000 | Not available | $999 + $15,000 (3%) = $15,999 | $75,000 (15%) |

| $1,000,000 | Not available | $999 + $30,000 (3%) = $30,999 | $129,000 (blended) |

At every price point, Flippa is cheaper on paper. But here's the catch: Empire Flippers often gets higher sale prices because buyers trust the vetting process. A business that sells for $80K on Flippa might fetch $100K+ through Empire Flippers, potentially netting you more even after the higher commission.

Additionally, when using Flippa's brokered service for deals over $100K, the fee difference narrows significantly-and you still won't get the migration support or buyer quality that Empire Flippers provides.

Buyer Experience Comparison

I was up late on a Wednesday – sitting in my car outside a storage unit I was trying to empty out during a rough stretch – browsing listings on the first platform. No account required, just scrolling. That part felt open. Then I hit the wall. Found a listing that looked genuinely interesting, went back the next morning to dig in, and it was under offer. Later I found out paying members get 21 days of early access. So the free experience is real, but you are essentially shopping the leftovers.

Due diligence fell entirely on me. The seller wrote their own description. I cross-referenced their traffic claims manually and found a gap I almost missed. There is no migration help either. I asked Chris about it after he went through a transfer on his own – he said it took him about three weeks just to sort out the hosting handoff on a site with four integrations.

The second platform was a different experience from the first login. Before I could see a URL or a business name, I had to verify my identity and connect proof of funds. It felt invasive until I understood why it existed. Once I cleared it, I unlocked roughly 23 listings within my verified range in the first session.

For anything serious, they set up a call between you and the seller. Migration is handled for you – no third-party contractors, no chasing down credentials at midnight. I estimated it saved me somewhere between $2,000 and $3,500 compared to doing it independently.

The part that actually changed how I think about acquisitions: a 14-day inspection window after migration. If the business earns less than 50% of what was advertised, you can renegotiate or walk. I did not need it. But knowing it existed made me more willing to move forward than I would have been otherwise.

Understanding Valuation Multiples

One crucial factor in buying or selling online businesses is understanding how they're valued. Both platforms use monthly profit multiples, but the actual multiples vary significantly.

Slept in the office conference room last night because my sublet fell through. Chris found me at 6am and asked if I was meditating. I said yes. He seemed genuinely inspired.

Typical Valuation Multiples by Business Type

SaaS businesses: Command the highest multiples, typically 40-70x monthly profit (or roughly 3.5-6x annual profit) due to recurring revenue predictability.

E-commerce: Generally sell for 25-45x monthly profit (2-3.75x annual) depending on inventory model, supplier relationships, and brand strength.

Content/affiliate sites: Typically 25-40x monthly profit (2-3.3x annual), with higher multiples for sites with diversified traffic and revenue sources.

Amazon FBA: Usually 25-35x monthly profit (2-3x annual), influenced heavily by supplier relationships and account health.

Dropshipping: Lower multiples at 20-30x monthly profit (1.7-2.5x annual) due to lower barriers to entry and supplier dependencies.

Factors That Increase Multiples

- Diversified traffic sources: Multiple channels (organic, paid, social, email) reduce risk

- Strong financials: Consistent or growing revenue with clear documentation

- Low owner involvement: Systems and automation that reduce time commitment

- Recurring revenue: Subscriptions, memberships, or repeat customers

- Growth opportunities: Clear paths to scale the business further

- Established brand: Recognizable brand with customer loyalty

Empire Flippers generally achieves higher multiples because their vetting process provides buyer confidence. Flippa's self-service listings typically trade at lower multiples due to perceived risk, though their brokered service can achieve comparable valuations.

Who Should Use Which Platform?

I listed a content site on the self-serve platform at around midnight on a Wednesday. I was sitting in the parking lot of an urgent care, waiting on news about a family thing. Not my clearest headspace. But I got the listing live in about 40 minutes, which surprised me. The process didn't hold my hand, and I had to figure out the transfer documentation mostly on my own. Ended up leaning on a forum thread to get through it. It worked, but it wasn't clean.

That experience is basically the filter. If your business is pulling under $2K a month, or you're offloading a side project or starter site, the self-serve route makes sense. You'll deal with some tire-kickers. I had maybe 60% unserious inquiries before closing. That's the tradeoff for the volume.

If you're above that threshold, the managed side is a different animal. Chris moved a SaaS asset through the vetted platform and said the buyer quality alone justified the fee. Verified financials, migration support, escrow built in. He didn't chase anyone. That's what you're paying for.

Alternative Platforms Worth Considering

While Flippa and Empire Flippers dominate the online business marketplace, several alternatives serve specific niches:

Motion Invest

Specializes in content sites under $100,000. They offer a faster process than Empire Flippers but focus exclusively on content-based businesses. Good for sellers who want quick exits on smaller content sites.

Stephanie mentioned she's thinking about buying a "little weekend place" in Aspen. I'm thinking about which friend's couch accepts weekend guests. Different scales, same planning energy.

FE International

A high-end brokerage focusing on SaaS, e-commerce, and content businesses typically valued over $1 million. They offer white-glove service with personalized deal structuring and often achieve premium multiples through strategic buyer matching.

Acquire.com

Popular for SaaS and tech startups, particularly those with venture backing or looking for strategic acquirers. Different buyer audience focused on software and technology businesses.

Investors Club

A newer marketplace that charges no listing fees and no success fees for sellers. They offer curated listings and confidential sales, making them an interesting middle ground between Flippa and Empire Flippers.

Acquire is basically the Tinder of startup acquisitions-swipe through businesses, match with buyers. It's slick and modern, but the quality varies wildly because anyone can list anything.

Digital Exits

Focuses on mid-market deals ($500K-$50M) with a strong emphasis on SaaS and subscription businesses. Good for larger exits requiring sophisticated deal structuring.

Due Diligence: What Buyers Must Verify

Regardless of which platform you use, buyers should always conduct thorough due diligence:

My phone's about to get shut off but I still sent today's 6am motivational texts. Seven clients replied saying it changed their morning. That's what matters.

Financial Verification

- Request bank statements, PayPal/Stripe reports, and tax returns

- Verify revenue claims against actual deposits

- Understand all expenses, including hidden costs

- Check for seasonal variations in revenue

- Confirm profit margins are sustainable

Traffic Analysis

- Review Google Analytics data for traffic trends

- Check traffic sources and their sustainability

- Verify search rankings for key terms

- Identify any recent algorithm impacts

- Analyze bounce rates and user engagement

Operational Assessment

- Document all processes and systems

- Identify time commitment required

- Review supplier/vendor relationships

- Check for legal issues or pending disputes

- Verify ownership of all assets (domains, content, accounts)

Growth Potential

- Identify untapped opportunities

- Assess competition and market position

- Evaluate scalability of the model

- Consider technical debt or required updates

Empire Flippers handles much of this verification before listing, while Flippa buyers (especially on self-service listings) must conduct all due diligence themselves.

The Escrow Process Explained

Both platforms facilitate secure transactions, but in different ways:

Flippa's Escrow Options

Flippa partners with Escrow.com and offers FlippaPay. Escrow fees are paid by the buyer and vary by transaction size. For example, a $50,000 purchase might cost $1,500-$2,000 in escrow fees. Flippa offers a 20% discount on Escrow.com fees when initiated through their platform.

The typical process:

- Buyer wires funds to escrow

- Seller transfers assets

- Buyer has 7 days to inspect and approve

- Funds released to seller

Empire Flippers' Escrow Process

Empire Flippers handles escrow internally at no additional cost. Their migration team manages the transfer process, which typically takes 14-30 days depending on business complexity.

The process includes:

- Buyer wires funds to Empire Flippers

- Migration team begins transfer

- Step-by-step asset migration with documentation

- 14-day inspection period begins after migration

- If revenue is at least 50% of advertised, funds release to seller

Empire Flippers also manages earn-out agreements if negotiated, collecting payments from buyers and distributing to sellers over time.

Success Stories and What We Can Learn

I listed a content site on the auction-style platform first. It sold. Not fast, not clean, but it sold. The buyer pool is real and when you get two or three of them competing, the price moves. Mine cleared about 11% over my floor. What made the difference was documentation. I had everything ready before I posted. Chris had warned me about that. Sellers who show up unprepared get eaten alive in the Q&A.

The curated platform is a different experience. I submitted a SaaS project and it sat in vetting for longer than I expected. Frustrating at the time. But when it went live, the conversations with buyers were different. No tire-kickers. No one asking if the revenue was real. That pre-qualified trust is worth something. Their close rate is reportedly above 94%, and honestly that tracks with what I saw.

Two exits taught me the same thing: documentation is the product.

Common Mistakes to Avoid

I listed my first business on the wrong platform and lost six weeks. By the time I figured out why nothing was moving, I'd already made most of these mistakes. Here's what I'd tell myself before I started comparing flippa vs empire flippers in any serious way.

Sellers: I overvalued mine by about 30% because I was anchoring to revenue instead of comparable exits. Documentation killed me too. I had the numbers but they were scattered across three tools. Buyers asked twice, then went quiet. Keep your metrics tight before you list, not after.

Buyers: I skipped a real revenue audit on one acquisition. Took me roughly ~11 days post-close to realize the traffic was mostly referral spam. Not all traffic converts. Verify the sources line by line before you wire anything.

The Bottom Line

These two platforms are not really fighting over the same sellers. I figured that out the hard way, after listing in the wrong place and watching three weeks go quiet.

I was in a rough stretch. Sleeping poorly, behind on everything, managing a sale I was not emotionally ready for. I pulled up the dashboard from my car outside a Walgreens at midnight and decided to just commit to one platform. That decision taught me more than any comparison article had.

The first one is the Wild West and it knows it. Lower fees, fewer guardrails, and you are entirely responsible for what happens. I ran into inflated numbers twice in the first week of browsing. Verified nothing. Buyers ghosted. But for smaller deals, especially anything under $50K that would not qualify elsewhere, it is often the only realistic option. Their newer brokered tier is reaching toward the mid-market, but the migration support and buyer quality are not there yet. I listed something small through it and got ~40 inquiries in 10 days. Maybe six were real.

The second platform is a different experience entirely. You pay a 15% commission and in exchange you get vetting, actual migration support, and buyers who have already been screened. My listing moved faster there and the offers came in cleaner. Their success rate is above 94%, which tracks with what I saw. The buyers did not waste my time.

For anything in the $5K to $50K range, I'd start with the scrappier one. Save on fees, move faster, just go in with your eyes open and verify everything yourself. Chris told me he lost two weeks on a deal because he trusted a screenshot instead of requesting live access. Do not do that.

For deals between $100K and $1M, the fee difference starts to matter less than the outcome. The premium platform typically gets higher multiples and handles more of the heavy lifting. If you qualify, the commission earns itself.

Above $1M, I would be talking to FE International or Digital Exits alongside the premium option. Different level of deal structuring required.

What I would tell anyone starting this process: prepare your financials before you list anything anywhere. Seriously. Buyers who have to chase P&Ls disappear. I lost one solid offer because I was slow pulling documentation during a chaotic week. The right prep adds more to your sale price than any fee savings will.