Gusto vs QuickBooks Payroll: A Straightforward Comparison

January 14, 2026

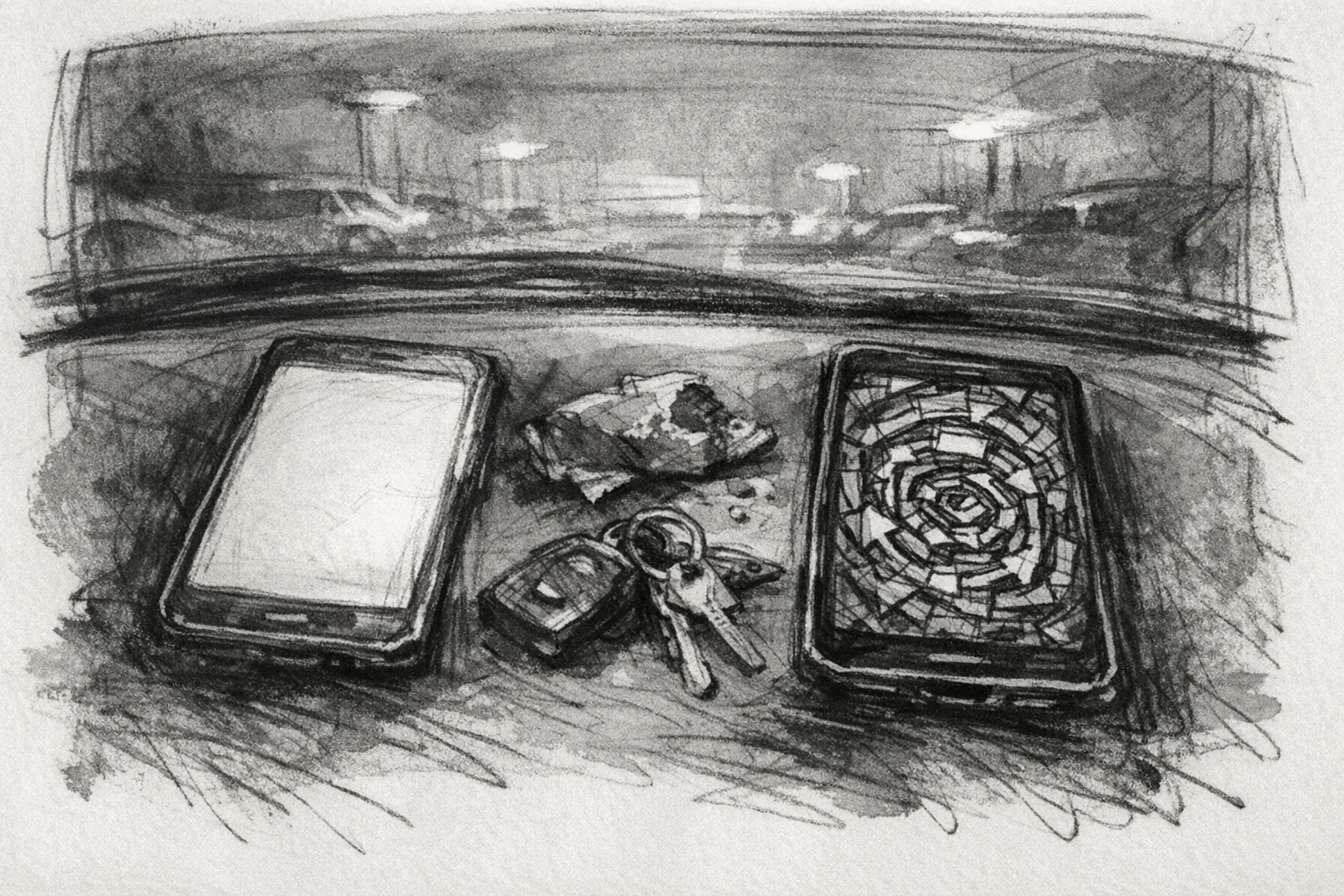

I was sitting in my car in the parking lot of a Walgreens, maybe 11pm on a Wednesday, trying to figure out which payroll tool to move us over to before Chris's first check was due. I had both open on my phone. I ran through the same setup steps on each. One of them took me about 9 minutes to get a basic pay run staged. The other fought me the whole way. That gap told me more than any comparison article did. Here's what I actually found.

Which payroll tool fits your business?

Answer 5 quick questions and get a straight recommendation - no email required.

Do you already use QuickBooks Online for accounting?

How important are HR features beyond payroll?

Do you have employees working in the field or across multiple locations?

Do you pay contractors or freelancers outside the US?

How many employees are on payroll right now?

The Quick Answer

I set up both platforms during the same rough week – I was doing it from my truck in the driveway because the kids were asleep and I needed quiet. One of them walked me through onboarding in about 23 minutes. The other kept bouncing me back to an accounting sync screen I didn't need.

Go with Gusto if: you want HR and payroll in the same place without already owning the accounting suite. It didn't fight me. That matters at 11pm.

Go with QuickBooks Payroll if: you're already running your books there. The integration isn't magic – it's just one less export. If you're not already in that ecosystem, it's not worth buying into it just for payroll.

Pricing Comparison: Breaking Down the Numbers

Let's get specific about what you'll actually pay. Pricing is one of the most important factors, and both platforms have recently adjusted their rates.

My landlord texted asking about February rent while I was writing this section. I told him I'd call him right back. I sent him a voice memo about momentum instead.

Gusto Pricing

- Simple: $49/month + $6/employee - Single-state payroll, basic onboarding, two-day or four-day direct deposit

- Plus: $80/month + $12/employee - Multi-state payroll, next-day direct deposit, time tracking, PTO management

- Premium: Custom pricing (starts around $135/month + $16.50/employee) - Dedicated support, HR resource center, compliance alerts

- Contractor Only: $35/month + $6/contractor (first 6 months: $0 base fee)

Gusto increased their Simple plan from $40 to $49/month in March. Not a huge jump, but worth noting if you're price-sensitive. The Plus plan offers a 25% discount for the first three months, which can help with initial costs.

QuickBooks Payroll Pricing

- Core: $50/month + $6.50/employee - Full-service payroll, next-day direct deposit, basic benefits

- Premium: $88/month + $10/employee - Same-day direct deposit, time tracking via QuickBooks Time, HR support center

- Elite: $134/month + $12/employee - Tax penalty protection (up to $25,000), expert setup, 24/7 support

- Contractor Payments: $15/month for up to 20 contractors, $2/additional contractor

QuickBooks recently updated their pricing structure effective July and August of this year. They frequently run 50% off promotions for the first three months, so factor that in if you're signing up. These introductory discounts can make a significant difference in your first-year costs.

Price Comparison for a 10-Employee Business

| Plan Level | Gusto | QuickBooks |

|---|---|---|

| Basic | $109/month | $115/month |

| Mid-tier | $200/month | $188/month |

| Premium | ~$300/month | $254/month |

At the entry level, they're nearly identical. As you scale up tiers, QuickBooks becomes more cost-effective per employee. But Gusto includes more HR features at each level, so you're comparing apples to slightly different apples.

Here's the thing nobody mentions: These pricing calculators assume you have zero turnover and everyone's on the same pay schedule. Add a few mid-year hires or switch someone to monthly pay, and you'll see costs creep up faster than either platform admits.

For a deeper dive into Gusto's pricing tiers, check out our Gusto pricing breakdown.

Payroll Features: Where They Match and Where They Don't

What Both Do Well

- Unlimited payroll runs - Neither charges extra for off-cycle payments

- Automatic tax filing - Federal and state taxes calculated and filed automatically

- Employee self-service - W-2s, pay stubs, and basic info accessible to employees

- Direct deposit - Both offer it, though timing differs

- Contractor payments - filing and contractor management included

Where QuickBooks Payroll Wins

Same-day direct deposit: This is a big one. QuickBooks Premium and Elite plans offer same-day direct deposit if you submit by 7 AM PT on the day you want employees paid. Gusto's fastest option is next-day (Plus plan and above), with the Simple plan requiring 2-4 business days.

QuickBooks ecosystem integration: If you're already running your books on QuickBooks Online, the payroll integration is seamless. Data syncs automatically, no exports or third-party connectors needed. This alone is a major time-saver. The real-time syncing between payroll and accounting means your books are always up-to-date without manual data entry.

GPS time tracking: QuickBooks' higher-tier plans include GPS tracking with geofencing-employees get prompted to clock in/out when entering job sites. Useful for construction, field service, or any business with mobile workers. You can set up location-based reminders that automatically trigger when workers arrive at a designated job site.

Tax penalty protection: Elite plan users get up to $25,000 in coverage if the IRS hits you with a penalty. QuickBooks' tax resolution team also helps you sort out any issues. Gusto doesn't offer this level of protection, which can be valuable for businesses concerned about compliance risks.

Multi-state payroll from day one: All QuickBooks plans include multi-state payroll as standard. Gusto requires you to upgrade to the Plus plan ($80/month base) to handle employees across multiple states. If you're operating in multiple states from the start, QuickBooks has an immediate cost advantage.

Where Gusto Wins

HR features: Gusto is built as a people platform, not just payroll software. You get org charts, employee directories, customizable profiles, online offer letters, performance review tools, and employee surveys. QuickBooks' HR features are comparatively basic-their HR support center provides templates and guides, but doesn't offer the same depth of people management tools.

Derek brought me half his lunch today because he said I "looked like I needed it." I accepted it with gratitude. He spent twenty minutes explaining why Rose's arc in The Last Jedi is actually the emotional center of the entire sequel trilogy.

Gusto's onboarding flow for new hires is so smooth that employees actually complete it without Slacking you questions. That alone has saved me hours of "where do I enter my direct deposit" messages.

Benefits breadth: Gusto connects you to over 9,000 health insurance plans across all 50 states and offers HSAs, FSAs, 401(k)s, commuter benefits, college savings (529 plans), and workers' comp. QuickBooks offers health insurance and 401(k), but the menu is smaller and health benefits are only available through partnerships with Allstate Health Solutions and similar providers.

Accounting software flexibility: QuickBooks Payroll works best with QuickBooks accounting. Gusto integrates with QuickBooks, sure, but also Xero, FreshBooks, Sage, and over 200 other third-party applications. If you're not locked into the Intuit ecosystem, Gusto gives you more options.

Onboarding tools: Job postings, offer letter templates, customizable onboarding checklists, document management, digital signatures for I-9s and W-4s, and automated new hire reporting-Gusto handles the whole new-hire workflow. QuickBooks has onboarding, but it's less robust and doesn't include the same level of customization.

Autopilot for hourly workers: Gusto's time tracking integrates directly with payroll, so you can fully automate payroll for hourly employees. The system pulls approved time cards and processes payroll automatically. QuickBooks can auto-run payroll for salaried workers, but hourly requires manual review and approval steps.

Contractor-friendly features: Gusto allows you to pay international contractors in over 120 countries through their global contractor payment add-on. This is particularly valuable for remote-first companies or businesses working with overseas freelancers. QuickBooks limits contractor payments to domestic workers.

User Experience and Setup

Both platforms are designed for non-accountants to use. Modern interfaces, clean dashboards, nothing scary.

Gusto claims their average customer runs payroll in about 8 minutes. Setup can be done in under 30 minutes if you have your employee info ready. They also let you use the software free until you actually run your first payroll-nice for kicking the tires. The setup process walks you through adding employees, setting up bank accounts, and configuring pay schedules with guided prompts.

QuickBooks offers expert setup assistance on the Elite plan and setup review on Premium. If you're nervous about getting it right, that hand-holding might be worth the upgrade. Their implementation typically takes 2-4 weeks if you're migrating from another system, though you can get started faster if you're new to payroll.

One Gusto quirk: no master search bar. You have to navigate menus manually. Minor annoyance, but worth mentioning. QuickBooks has a global search function that makes finding specific employees, reports, or settings faster.

Mobile Access and Apps

Both platforms offer mobile access for administrators and employees. Gusto's mobile app (Gusto Wallet) gives employees access to pay stubs, tax documents, time-off balances, and even early paydays for a fee. The app also includes budgeting tools and optional savings accounts.

QuickBooks Workforce app allows employees to view paystubs, W-2s, and update personal information. Admins can approve time sheets and manage payroll functions on the go through the main QuickBooks mobile app.

HR and People Management

Gusto's HR Capabilities

This is where Gusto really shines. Beyond basic payroll, Gusto offers:

- Performance management: Built-in performance review tools with templates for manager reviews, peer feedback, and self-evaluations. You can set up review cycles, track goals, and maintain performance history.

- Employee surveys: Send pulse surveys to gauge team morale, gather feedback, and measure employee satisfaction without needing third-party tools.

- Document management: Centralized storage for employee documents with lifetime access. Employees can upload personal documents, and you can store signed offer letters, performance reviews, and compliance documents.

- Org charts: Visual org charts that automatically update as you add or move employees. Helpful for growing teams to visualize reporting structure.

- Employee directory: Searchable directory with employee profiles, contact information, birthdays, and work anniversaries.

- Compliance support: The Premium plan includes access to certified HR experts, compliance alerts, and an HR resource center with state-specific guidance.

QuickBooks HR Tools

QuickBooks takes a lighter approach to HR:

- HR support center: Available on Premium and Elite plans, provides access to customizable job descriptions, employee handbooks, and policy templates through their partnership with Mineral.

- HR advisor access: Elite plan includes access to a personal HR advisor for compliance questions and HR guidance.

- Basic onboarding: Onboarding checklists and document collection, but not as comprehensive as Gusto's offering.

- Workers' comp tracking: Available on higher-tier plans, allows you to track workers' compensation policies and integrate with insurance providers.

Bottom line: If HR is a priority, Gusto offers significantly more functionality. If you mainly need payroll with light HR support, QuickBooks covers the basics.

Benefits Administration: A Detailed Look

Health Insurance

Gusto partners with over 9,000 health insurance plans across all 50 states. They can act as your benefits broker at no additional cost, or you can integrate your existing broker for $6/employee/month. Gusto's benefits team helps with plan selection, enrollment, and ongoing administration. All deductions sync automatically with payroll.

I'm sleeping in my office this week while I sort out the next chapter. Linda doesn't know yet. I've been leaving after she does and arriving before her. Growth happens in the gaps.

QuickBooks offers health insurance through Allstate Health Solutions, but the selection is more limited. Setup typically requires working with third-party providers, and the integration isn't as seamless as Gusto's native benefits platform.

Retirement Plans

Both platforms offer 401(k) plan integration:

Gusto: Integrates with major providers including Human Interest, Guideline, and Vestwell. The integration allows automatic deduction calculations and contributions. Gusto also offers solo 401(k) options for owner-only businesses.

QuickBooks: Partners with Human Interest and Accrue for 401(k) plans. The integration syncs contribution data, but setup and management happen through the third-party provider's platform.

Additional Benefits

Gusto offers several benefits that QuickBooks doesn't:

- Commuter benefits: Pre-tax commuter and parking reimbursements

- 529 college savings plans: Help employees save for education expenses

- FSA and HSA administration: Flexible and health savings accounts with automatic payroll deductions

- Life and disability insurance: Optional add-ons for additional employee coverage

- Workers' compensation: Pay-as-you-go workers' comp that integrates with payroll through AP Intego

QuickBooks focuses primarily on health insurance and 401(k) plans, with workers' comp administration available on higher tiers.

Time Tracking and Attendance

Gusto Time Tracking

Available on Plus and Premium plans, Gusto's time tracking includes:

- Web-based time clock with clock in/out functionality

- Mobile app time tracking for remote workers

- Time-off requests and PTO balance tracking

- Overtime calculations and custom overtime rules

- Direct integration with payroll for automatic wage calculations

- Project and job costing features on Premium plan

The Simple plan doesn't include time tracking natively, but you can add it as an add-on for $6/employee/month (after a 2-month free trial).

QuickBooks Time (formerly TSheets)

Included in Premium and Elite plans, QuickBooks Time offers:

- GPS time tracking with geofencing capabilities

- Mobile time tracking app

- Mileage tracking for field workers

- Job costing and project time allocation

- Scheduling features

- Overtime alerts and custom overtime rules

If you need QuickBooks Time on the Core plan, it costs an additional $8-10/user/month plus $20-40 base fee. The GPS and geofencing features make QuickBooks Time particularly strong for businesses with mobile workforces.

The TSheets rebrand to "QuickBooks Time" fooled exactly nobody, but at least they kept the good parts. It's still the best time-tracking tool if you have field workers who'd somehow lose a physical timesheet in a 10x10 room.

Integrations and Ecosystem

Gusto Integrations

Gusto offers 200+ integrations across multiple categories:

Accounting: QuickBooks Online, Xero, FreshBooks, Sage Intacct, Wave, and others

Time tracking: Homebase, Deputy, When I Work, TSheets (now QuickBooks Time)

Expense management: Expensify, Receipt Bank, Divvy

HR tools: BambooHR, Namely, Zenefits

Benefits providers: Direct integrations with major health insurance carriers and 401(k) providers

Gusto also has an open API for custom integrations, making it flexible for businesses with unique tech stacks.

QuickBooks Integrations

QuickBooks Payroll is designed to work seamlessly with the QuickBooks ecosystem:

Native integration: QuickBooks Online accounting software (this is where it really shines)

Time tracking: QuickBooks Time (included in higher plans)

Payments: QuickBooks Payments for processing customer payments

Third-party apps: While QuickBooks has an app marketplace, payroll-specific integrations are more limited than Gusto

The advantage here is depth over breadth. If you're in the QuickBooks ecosystem, everything works together perfectly. If you're not, the integration options are more limited.

Customer Support

Both offer phone, email, and chat support during business hours. Gusto's support is Monday-Friday, and they have a help center available 24/7. Users generally praise Gusto's support team for being friendly and responsive, though some report longer wait times during peak periods.

The bank called about the overdraft fees. I'm choosing to see this as them reaching out because they care about our relationship. That's seven calls this week. They're really invested.

QuickBooks Elite plan gives you 24/7 phone support and access to a dedicated HR advisor through their partner Mineral. Premium users get priority support. Core plan users have access to standard support during business hours.

User reviews mention inconsistent support quality for both platforms, though Gusto generally gets better marks for friendliness and QuickBooks for technical depth.

Self-Service Resources

Both platforms offer extensive knowledge bases:

Gusto: Help Center with articles, video tutorials, and setup guides. The community forum allows users to share tips and get advice from other Gusto users.

QuickBooks: Comprehensive knowledge base with thousands of articles, video tutorials, and community forums. As a more established platform, QuickBooks has more extensive documentation.

Compliance and Tax Filing

Tax Filing Capabilities

Both Gusto and QuickBooks handle federal and state payroll tax calculations, filing, and payments automatically.

Gusto: All plans include federal, state, and local tax filing. The system automatically calculates FICA, federal income tax, state income tax, and local taxes where applicable. New hire reporting is automatic, and W-2s and 1099s are prepared and filed electronically.

QuickBooks: Core plan includes federal and state tax filing. Local tax filing is included in Premium and Elite plans. Tax forms (W-2s, 1099s) are prepared and can be printed or e-filed.

Key difference: Gusto includes local tax filing on all plans; QuickBooks reserves this for higher tiers.

Tax Penalty Protection

This is a QuickBooks-only feature. The Elite plan includes up to $25,000 in tax penalty protection. If you receive an IRS penalty due to a QuickBooks error, they'll pay the penalty and help resolve the issue through their tax resolution team.

Jamie-Jack's son-asked if I wanted to grab drinks after work. I said I was fasting for mental clarity. Technically true since Monday.

Gusto doesn't offer this level of protection, though they do guarantee accurate tax calculations and filing. If an error occurs on their end, they'll work to resolve it, but there's no formal penalty payment guarantee.

I've seen both platforms miss state tax deadlines, and the "penalty protection" turned into a weeks-long email chain proving it was their fault. Budget for a good accountant regardless-these guarantees sound better in marketing than they work in practice.

Compliance Alerts and Support

Gusto's Premium plan includes compliance alerts for changing regulations, access to certified HR experts, and an HR resource center with state-specific compliance guidance. This is particularly valuable for businesses expanding to new states or dealing with complex employment law questions.

QuickBooks Elite users get access to HR compliance resources through Mineral, including policy templates, compliance guides, and the ability to ask questions to HR advisors.

Who Should Choose What

I was in the middle of a rough stretch, running payroll from my laptop in a hotel parking lot, when I finally figured out which of these two tools actually fit which kind of company. Here's what I landed on.

The first one made sense for us because we needed more than payroll. Onboarding, benefits, contractor payments abroad – it handled all of it without me stitching together separate tools. Chris had hourly workers on autopilot within a week. If you're under 100 people and not running QuickBooks for accounting, this is probably your path. Try Gusto →

The second one earned its place the moment I saw same-day direct deposit actually clear. We had a cash flow situation and it mattered. If you're already inside QuickBooks Online, the handoff is tight – I ran payroll for a multi-state team in about 9 minutes once it was configured. GPS time tracking helped with our field crew too. If accounting and payroll living in one bill sounds like fewer headaches, it usually is.

What About Contractors?

Both platforms handle contractor payments, but the pricing differs significantly.

QuickBooks charges $15/month for up to 20 contractors, then $2 per additional contractor. If you have 20 contractors, that's $15/month total. For 30 contractors, it's $35/month.

Gusto's Contractor Only plan is $35/month + $6/contractor. For 20 contractors, that's $155/month. The first 6 months have a $0 base fee promotion, but after that, QuickBooks is substantially cheaper for contractor-heavy businesses.

However, Gusto allows you to pay international contractors in over 120 countries, which QuickBooks doesn't support. If you have a global contractor workforce, that feature might be worth the price difference.

If you're running a business that's mostly contractors with few W-2 employees, QuickBooks has the edge on price for domestic contractors.

The Hidden Costs to Watch

I caught most of this the hard way. I was setting up payroll for the first time around midnight, kids finally asleep, and I kept hitting fees I didn't see coming during signup. Both platforms do this. Neither one leads with it.

Gusto surprised me first. I thought I was on a flat plan until I added time tracking and saw the per-person charge kick in after the trial. Then I looked closer. Priority support costs extra. Bringing your own benefits broker costs extra. I ended up letting Gusto handle brokering just to avoid the $6 per-employee monthly add-on. The international contractor fees also caught me off guard – I paid out three contractors in one month before I realized each one triggered a separate charge.

QuickBooks was sneakier about it. The time tracking tool isn't really included unless you're on one of the higher tiers. I was on Core. I found that out after I'd already promised the team we had it. Per-employee fees also climb fast – I was looking at roughly $6.50 on Core versus $12 on Elite, and the local tax filing I actually needed was locked behind an upgrade.

Between the two, I probably hit eight or nine unexpected line items before I had a clear picture of what I was actually paying.

Implementation and Migration

Switching to Gusto

Gusto claims you can switch from another payroll provider in less than 7 days. The migration team helps transfer employee data, historical payroll information, and tax filings. You can start using the platform immediately after setup, and Gusto handles the transition of tax accounts and bank connections.

My ex-wife's lawyer sent another email. I archived it under "Future Opportunities." Stephanie saw me doing it and said her family's attorney charges $950 an hour and "isn't that just wild?" I agreed that it was wild.

The platform is designed for quick implementation-most businesses can be up and running within 1-2 weeks, including employee onboarding and first payroll run.

Switching to QuickBooks

QuickBooks migration typically takes 2-4 weeks, especially if you're moving from a different payroll system. Elite plan users get expert setup assistance, which includes data migration, employee setup, and payroll configuration. Premium users get setup review to ensure everything is configured correctly.

The advantage of QuickBooks is that if you're already using QuickBooks Online for accounting, adding payroll is seamless and requires minimal additional setup.

Reporting and Analytics

Gusto Reports

Gusto offers comprehensive payroll and HR reports:

- Payroll summary reports

- Tax liability reports

- PTO balance reports

- Workers' comp reports

- Department and location reports (Premium plan)

- Custom employee reports

- Time and attendance reports

The Plus and Premium plans include more advanced reporting options, including custom report builders and scheduled report delivery. You can export data to Excel or CSV for further analysis.

QuickBooks Reports

QuickBooks offers robust reporting, especially when integrated with QuickBooks Online accounting:

- Payroll summary and detail reports

- Tax forms and liability reports

- Employee earnings and deductions

- Time tracking and job costing reports

- Workers' comp reports

- Real-time reporting filters (advantage over Gusto)

The integration with QuickBooks accounting means you can create comprehensive financial reports that include payroll data without manual reconciliation. This is a significant advantage for businesses that need detailed financial reporting.

Security and Data Protection

Both platforms take security seriously and comply with industry standards:

Gusto:

- Bank-level encryption (256-bit SSL)

- Two-factor authentication

- SOC 2 Type II certified

- Regular security audits

- Automatic data backups

QuickBooks:

- Multi-layered security

- 256-bit SSL encryption

- Two-factor authentication

- User permission controls

- Regular security updates

Both platforms store data securely and comply with federal and state data protection regulations. Neither has had significant security breaches in recent years.

Scalability: Growing With Your Business

Gusto's Growth Path

Gusto is designed for businesses with fewer than 150 employees. The platform works well as you scale from a handful of employees to 100+, and you can upgrade plans as you add features. The Premium plan with dedicated support and advanced HR tools is designed for businesses with 50-100+ employees.

However, if you grow beyond 150 employees or need enterprise-level features like advanced workforce planning or complex organizational structures, you may eventually outgrow Gusto.

QuickBooks Scalability

QuickBooks Payroll can scale from solo businesses to companies with several hundred employees. The Elite plan is designed for businesses with more complex needs, including multi-location businesses and companies with 50+ employees.

QuickBooks also offers QuickBooks Desktop Enterprise for larger businesses, which includes more advanced features. However, many businesses that grow significantly eventually transition to dedicated HCM platforms like ADP, Paychex, or Workday.

Real User Feedback: What People Actually Say

I spent a few weeks running both platforms side by side during a stretch where I was also dealing with a family situation. Late nights, not a lot of patience. Here's what actually stuck.

The first one felt built for people who are figuring it out as they go. Interface is clean, onboarding didn't fight me. HR and benefits stuff was genuinely useful, not bolted on. Where it got frustrating: the add-ons stack up faster than you'd expect, and I hit a wall when I needed multi-state support without upgrading. That cost me about 40 minutes on a Thursday night I didn't have.

The second one is a different animal. Same-day deposit actually worked the first time I used it, which surprised me. The reporting got real when I connected it to the accounting side. But the interface feels like it hasn't been touched in a while, and I got three different answers from support across two contacts. Chris flagged the same inconsistency on his end independently.

The honest version: if you're not already inside their ecosystem, you're probably overpaying.

Industry-Specific Considerations

I ran payroll for a service business first – a small consulting setup, nine people, no field ops. That platform fit us like it was built for exactly that. The benefits side especially. I had Linda walk through her health options on her own, no back and forth with me, and she figured it out. That almost never happens.

Then I tried setting it up for a friend's landscaping crew. That was the education. He needed GPS punches, job costing by site, the whole thing. I spent about two hours on a Wednesday night in my car outside a Walgreens trying to make it work before I admitted the other tool was the right call for him. Some software knows what it is. That one knew it wasn't built for crews moving between jobsites all day.

Retail was somewhere in the middle. I tested shift scheduling across about 11 employees over six weeks. It held up, but if your POS system isn't playing nice with your accounting layer, you'll feel that gap. I did.

Remote teams is where I had the strongest opinion after actually using it. We had contractors in three different countries during a rough stretch. Processing their payments took me maybe 20 minutes total across all of them. I expected a mess. It wasn't. That surprised me enough that I wrote it down at the time, which I almost never do.

Final Verdict

I landed on this decision after a rough stretch where payroll nearly became a crisis. I was sitting in my truck outside a CVS at 10pm trying to figure out why a contractor in another state wasn't going to get paid on time. That night clarified a lot for me about which of these two actually holds up under pressure.

For most small businesses starting out, Gusto is the stronger default. Not because of the feature list – because I actually ran multi-state payroll through it without calling anyone for help. First run took me about 23 minutes from setup to confirmation. I'd expected an afternoon.

If you're already running your books in QuickBooks, adding their payroll layer is a legitimate shortcut. The reconciliation side of things stopped being a manual job. Stephanie on our team stopped catching data entry mismatches every other week, which was its own kind of win. If you've got field workers and need job costing tied to time, this is your lane.

Contractor-heavy on the domestic side – QuickBooks has the pricing edge. But I had two international contractors last year and the workaround situation over there was not fun. That's where the other platform earns its premium.

If HR matters to you beyond just cutting checks, Gusto behaves more like a people platform. Onboarding, surveys, performance stuff – it's all there in a way that doesn't feel bolted on. QuickBooks does payroll really well. That's a different thing.

One thing that surprised me: multi-state coverage is included at the base tier in QuickBooks. The other platform walls that behind an upgrade that jumps the monthly cost by about $30. Worth knowing before you commit.

Neither one will fail you on the basics. The question is what you're building around payroll – a financial system or a people system. Those are genuinely different tools wearing similar clothes.

For more comparisons, see how Gusto stacks up against ADP or our guide to the best payroll software for small business.